Council Tax bills arriving soon – here’s what to look out for

Bridport Town Council – Media Release – 5 March 2024

Dorset Council will be sending out bills for 2024-25 from 12 March and in Bridport, they’ll be different from previous years.

Council Tax is the amount paid by households each year for services provided by Dorset Council, Dorset Fire & Rescue, Dorset Police, and your local town or parish council. The annual bills covering the year April 2024 to March 2025 will be sent out by email or post from 12 March, and Bridport residents will see a change to the town/parish council element as a result of boundary changes that take effect on 1 April 2024.

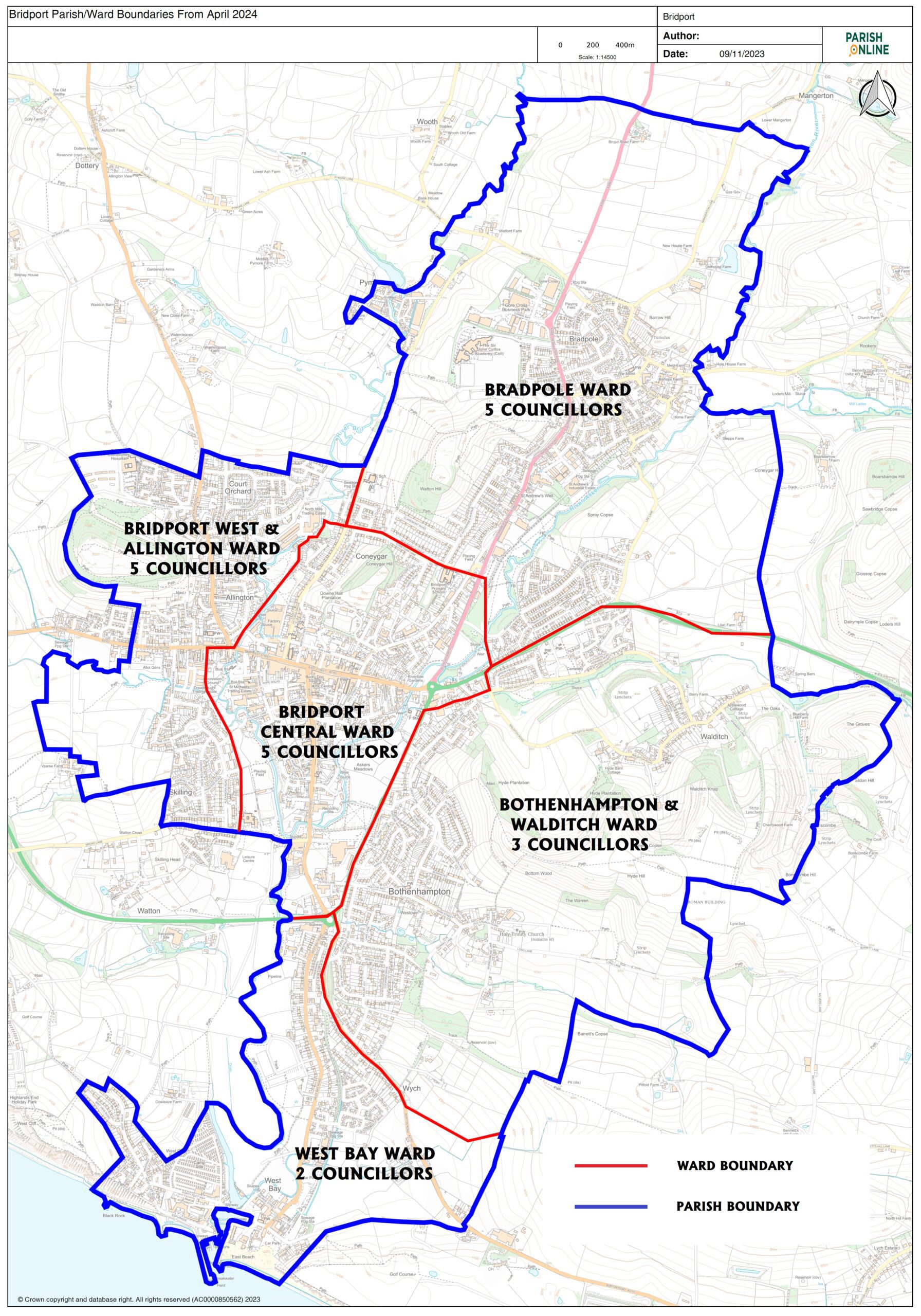

The boundary changes will see the dissolution of three parish councils – Allington, Bothenhampton & Walditch, and Bradpole – with the vast majority of homes in those areas becoming part of the Bridport Town Council area, along with a smaller number from Symondsbury parish. As a result, the bills for homes in these former parish areas will now show a contribution to Bridport Town Council, instead of to the parish councils. All households in the new Town Council area will, within each Council Tax band, pay the same amount (excluding any discounts or benefits). This levelling out of Council Tax across the town means that households in the old Town Council area will see a reduction in their town/parish element, while those in the former parish council areas will see an increase.

The total Council Tax bill for 2024-25, for a property in Band D (the band used for comparative purposes), will be £2,570.89 before any discounts or benefits. This is made up of charges levied by:

- Dorset Council £2,001.15 (77.8% of the total)

- Dorset Police £293.58 (11.4%)

- Bridport Town Council £189.21 (7.4%)

- Dorset Fire & Rescue £86.95 (3.4%)

Town Clerk Will Austin said “Council Tax bills are going to look a bit confusing for this year only, because of the boundary changes. I’d encourage anyone who wants more information about their bill to contact Council Tax team at Dorset Council – email [email protected] or call 01305 211970.”

Town Council Leader Cllr Dave Rickard said “The amalgamation of all our constituent parishes will see a fairer distribution of costs across the whole town, previously only just over half were meeting this cost. Town councillors strongly supported this change, which we also expect to result in contested elections across all of the 5 new wards into which the new Council area has been divided – so you will get more localised representation. Find out from the Town Council website [www.bridport-tc.gov.uk] which ward you are in and where you will need to vote.”

About 60% of households in the Town Council area are in bands lower than Band D so will see a lower charge. Some are also eligible for discounts and Council Tax Benefit that reduce the cost further. To find out whether you are eligible, contact Dorset Council’s Benefits Team by email, [email protected], or phone 01305 211930.

In a separate change to Council Tax in Dorset, a 100% premium will apply from this April, where a property has been empty and substantially unfurnished for more than one year. From 1 April 2025 a 100% premium will also apply to second homes.

To check which parish you live in, find your home on the interactive map at https://shared.xmap.cloud/?map=1613c0d9-ceb8-47c3-b7f8-20b172662fa8.